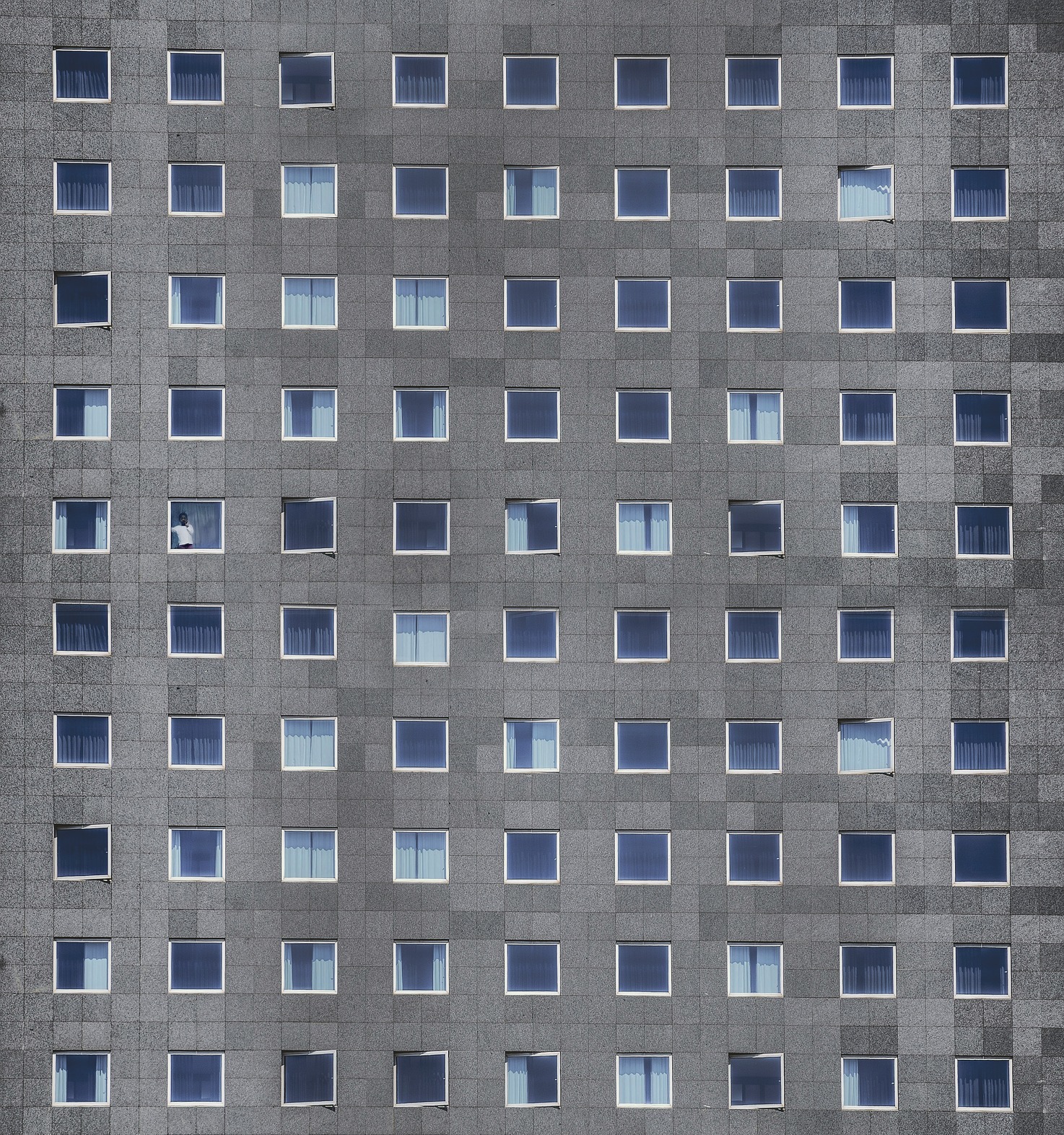

Block of Flats

Posted on 20th September 2022 at 08:24

Do you live in or manage a block of flats? 🏢 This one's for you.

Whats the issue?

For anyone living in, managing, insuring, or anything else associated with blocks of flats, they will know that the risk of loss with the highest probability is Escape of Water (EOW)💧

Background

For most flat leaseholders, they pay a contibution towards the cost of the Buildings insurance to a management company, which oversee the running and management of the flat.

Ultimately, unless there is an agreement towards the pooling of losses from the other flat owners, it is not within the interest of each flat owner to pay for the cost of any repairs or replacement from an insured claim, as they have paid for their share of the insurance premium and want to make a claim for the loss or damage, however small. This is natural and we see it all the time.

Warning⚠️

If you have multiple claims for losses arising from the same peril (EOW in this case), you will either have a higher excess or in the worst case, not get cover against losses arising from EOW and in any case, pay a higher premium.

This is because insurers assess the likelihood of an insured making a claim, and if there is a pattern of losses arising from the same insured peril, it is almost certain you will have a sizeable increased excess for losses arising from EOW and, in some cases, not get cover at all or at significant cost.

There has to be a better way.

Prevention is better than cure

Always, always, always. We recommend proactively managing the risk with a plumbing maintenance policy and a water leak detection system to detect any leaks at an early stage.

This will reduce the number of incidents, time, cost, inconvenience and aggrevation.

What about the residual risk?

We recommend flat leaseholders work together by agreeing in advance to share the cost of small claims, by self-insuring against losses up to a certain size, which can determined by factors like size. This takes a collaborative effort which often results in higher up front costs, but the block will ultimately benefit financially in the long run with lower premiums and widers covers.

💡Reminder, the cost of claims is ultimately borne by the policyholder.

Working together🤝

Ways of implementing, might be a higher service charge, which then means there is more in the pot to cover the cost of small attritinal losses and repairs etc and makes your flat more appealing when it comes to selling it, as the management company will have greater reserves for a rainy day making it more appealing to prospective buyers.

And the outcome?

Everyone wins!

Insurers deal with less claims, the total cost of claims is reduced (dont forget, the cost of claims include the associated costs like claims handling, loss adjusters, professional fees, etc and the policyholder benefits from lower premiums and wider covers, in place for when really needed to cover the cost of the large fortuitous losses that the insured cannot sustain in the short term.

The principle of insurance is restored🙏

Contact us on 01904 217455 or send an email to enquiries@johnsoninsurance.co.uk if we can assist you with your block of flats insurance policy or anything else you might like to discuss with us.

Share this post: